Why planners could soon face a tidal wave of rezoning requests

The commercial real estate world just hit a remarkable milestone and it is one that planners should have on their radar.

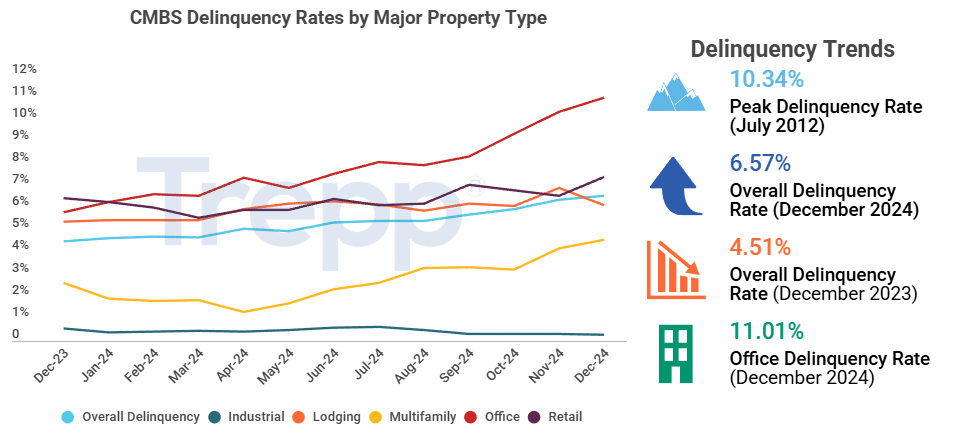

According to data from Trepp, the office Commercial Mortgage Backed Securities delinquency rate has climbed to about 11.7 percent which is the highest level ever recorded for the office sector. During the Great Recession this rate never reached the current level.

This development highlights growing stress across office buildings nationwide as more borrowers fall behind on their payments. What might look like a financial market story is already translating into a planning story as communities respond to the changing future of their commercial cores.

What this rate represents

Commercial Mortgage Backed Securities are created from pools of commercial real estate loans that are sold to investors. When the underlying borrowers miss payments or become seriously late those loans are considered delinquent.

The delinquency rate simply measures the percentage of the loan pool that is behind on payments. When this rate rises it signals increasing financial trouble among property owners.

An office delinquency rate of about 11.7 percent means that more than one of every ten dollars of office loan balances are now in distress. That number suggests that a significant share of office properties are experiencing financial hardship. In some cases the properties may already be underwater relative to their debt.

Why this matters for planners

The consequences of office distress do not stay contained within banking and finance. The effects ripple outward and local planners experience them in very real ways.

Empty office buildings often lead to:

• Reduced activity in downtown areas

• Declines in property tax revenue

• Lower demand for commercial services

• A search for new uses that can bring life back into these spaces

As building owners face economic pressure many are reevaluating their properties. This may mean selling at a discount, requesting new entitlements, or exploring entirely different land use strategies.

The result is a rising interest in converting traditional office buildings into housing, mixed use projects, educational facilities, or other creative solutions.

The coming surge in rezoning and redevelopment activity

If the delinquency rate continues to climb and refinancing remains difficult planners could see a noticeable increase in rezoning and redevelopment proposals.

Owners and investors will likely pursue new pathways to salvage or reposition their assets. This could involve:

• Rezoning from commercial to residential or mixed use

• Changes to building form or height standards

• Requests for adaptive reuse

• Revisions to parking requirements

• Variances connected to feasibility

Even cities that have been slow to see redevelopment pressure may begin receiving more inquiries as regional investment patterns shift.

This is not a sudden emergency event but a gradual wave already forming. Many office loans will mature during the next several years. Owners who cannot refinance under current interest rates may seek relief through redevelopment.

How communities can prepare

Every community will approach these challenges differently but several proactive steps can help planners keep ahead of the curve.

Assess land use policy

Reviewing current zoning and identifying areas that can support adaptive reuse will position a community to encourage productive investment.

Coordinate internally

Planning, economic development, and building departments benefit from working together early to understand the demands of new project types.

Evaluate capacity

Even without changing zoning rules an uptick in project volume can strain staff. Understanding how to scale review capacity will help avoid backlogs.

Encourage clear public communication

Residents are often invested in the future of downtown cores. Clear explanations of potential projects and policy changes help build understanding and trust.

About GeoCivix

Communities across the country are beginning to modernize their planning and permitting systems so they can handle changing development patterns more easily. GeoCivix provides online tools that support application intake, plan review, and collaborative communication which can help staff manage increased activity. If your community is considering updates to your process we are happy to share what we have learned from cities facing similar transitions.